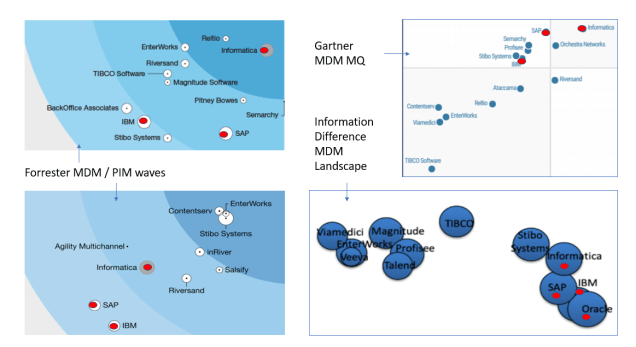

Over at the sister site, The Disruptive MDM / PIM List, there are some blog posts that are interviews with some of the people behind some of the most successful Master Data Management (MDM) and Product Information Management (PIM) tools.

CEO & Founder Upen Varanasi of Riversand Technologies provided some insights about Riversand’s vision of the future and how the bold decisions he had made several years ago led to the company’s own transformational journey and a new MDM solution. Read more in the post Cloud multi-domain MDM as the foundation for Digital Transformation.

In a recent interview FX Nicolas, VP of Products at Semarchy, tells about his MDM journey and explains how the Semarchy Intelligent Data Hub™:

- Extends the scope of data available via the data hub beyond core master data

- Takes an end-to-end approach for the data management initiative

- Transparently opens the initiative to the whole enterprise

Read the full interview here.

I hope to be able to present more people behind successful solutions on The Disruptive MDM / PIM List Blog.