On the edge of the New Year, it is time to guess what will be the hot topics in data management next year. My top three candidates are:

- Continued Enablement of Augmented Data Management

- Embracing Data Ecosystems

- Data Management and ESG

Continued Enablement of Augmented Data Management

The term augmented data management is still a hyped topic in the data management world. “Augmented” is here used to describe an extension of the capabilities that is now available for doing data management with these characteristics:

- Inclusion of Machine Learning (ML) and Artificial Intelligence (AI) methodology and technology to handle data management challenges that until now have been poorly solved using traditional methodology and technology.

- Encompassing graph approaches and technology to scale and widen data management coverage towards data that is less structured and have more variation than data that until now has been formally managed as an asset.

- Aiming at automating data management tasks that until now have been solved in manual ways or simply not been solved at all due to the size and complexity of the work involved.

It is worth noticing that the Artificial Intelligence theme lately has been dominated by generative AI and namely ChatGPT. However, for data management generative AI will in my eyes not be the most frequently used AI flavor. Learn more about data management and AI in the post Three Augmented Data Management Flavors.

Embracing Data Ecosystems

The strength of data ecosystems was latest examined here on the blog in the post From Platforms to Ecosystems.

Data ecosystems include:

- The infrastructure that connects ecosystem participants and help organizations transform from local and linear ways of doing business toward virtual and exponential operations.

- A single source of truth for ecosystem participants that becomes a single source of truth across business partner ecosystems by providing all ecosystem participants with access to the same data.

- Business model and process transformation across industries to support agile reconfiguration of business models and processes through information exchange inside and between ecosystems.

In short, your organization cannot grow faster than your competitors by hiding all data behind your firewall. You must share relevant data within your business ecosystem in an effective manner.

Data Management and ESG

ESG stands for Environmental, Social and Governance. This is often called sustainability. In a business context, sustainability is about how your products and services contribute to sustainable development.

When working as a data management consultant I have seen more and more companies having ESG on top of the agenda and therefore embarking on programs to infuse ESG concepts into data management. If you can tie a proposed data management effort to ESG, you have a good chance of getting that effort approved and funded.

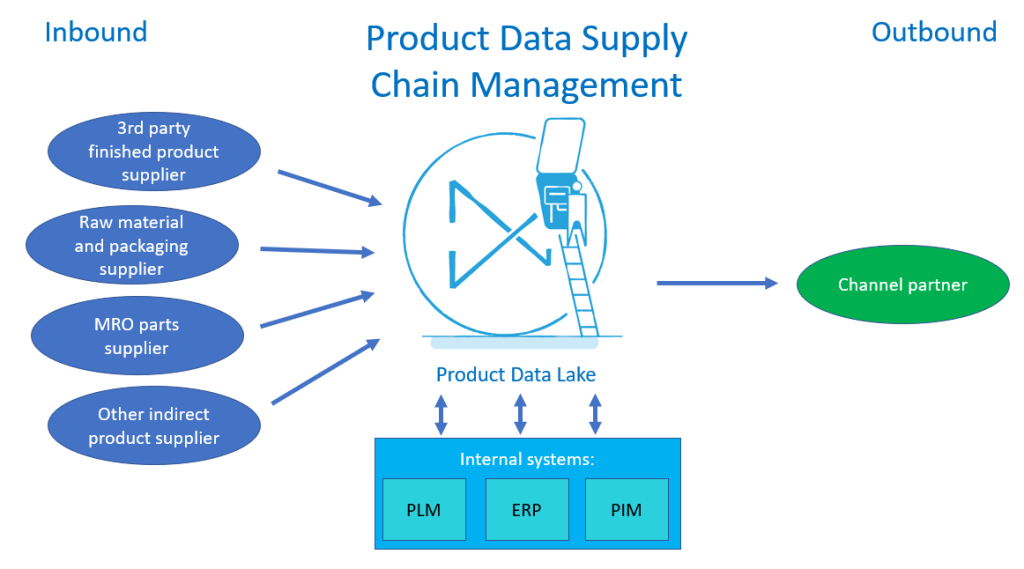

Capturing ESG data is very much about sharing data with your business partners. This includes getting new product data elements from upstream trading partners and providing such data to downstream trading partners. These new data elements are often not covered through traditional ways of exchanging product data. Getting the traditional product information through data supply chains is already challenged so adding the new ESG dimension is a daunting task for many organizations.

Therefore, we are ramping up to also cover ESG data in the collaborative product data syndication service I am involved in and is called Product Data Lake.