On the second last day of the year it is time to predict about next year. My predictions for the year gone were in the post Annus Horribilis 2020, Annus Mirabilis 2021?. These predictions were fortunately fluffy enough to claim that they were right.

There is no reason not to believe that the wave of digitalization will go on and even intensify. Also, it seems obvious that data management will be a sweet spot of digitalization.

The three disciplines within data management focussed on at this blog are:

- MDM: Master Data Management

- PIM: Product Information Management

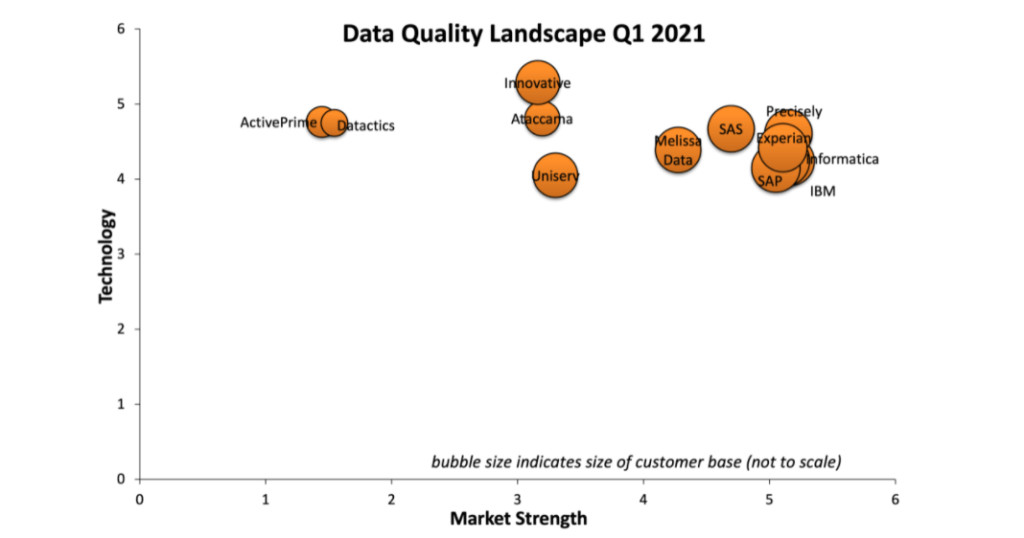

- DQM: Data Quality Management

So, let`s look at what might happen next year within these overlapping disciplines.

MDM in 2022

MDM will keep inflating as explained in the post How MDM inflates.

More organizations will go for enterprise wide MDM implementations and those who accomplish that will continue to do interenterprise MDM.

More business objects will be handled within the MDM discipline. Multidomain MDM will in more and more cases extend beyond the traditional customer, supplier and product domain.

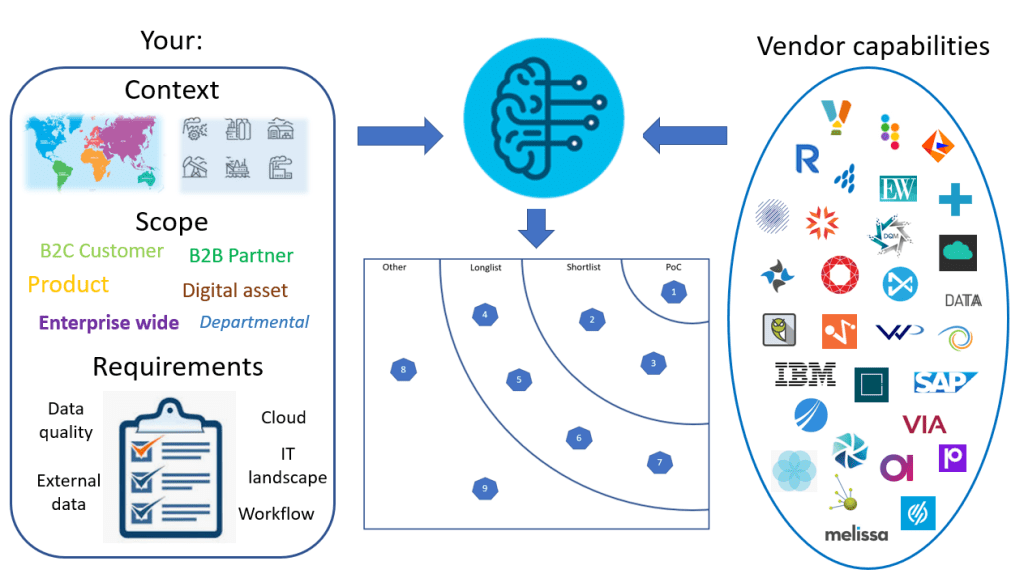

Intelligent capabilities as Machine Learning (ML) and Artificial Intelligence (AI) will augment the basic IT capabilities currently used within MDM.

PIM in 2022

As with MDM also PIM will go more interenterprise wide. As organizations get a grip on internal product data stores the focus will move to collaborating with external suppliers of product data and external consumers of product data through Product Data Syndication.

In some industries PIM will start extending from the handling the product model to also handling each instance of each product as examined in the post Product Model vs Product Instance.

There will also be a term called augmented PIM meaning using Machine Learning and Artificial Intelligence to improve product data quality. In fact, classification of products using AI has been an early use case of AI in data management. This use case will be utilized more and more besides other product information use cases for AI and ML.

DQM in 2022

Data quality management will also go wider as data quality requirements increasingly will be a topic in business partnerships. More and more contracts between trading partners will besides pricing and timing also emphasize on data quality.

Data quality improvement has for many years been focused on the quality of customer data. This is now extending to other business objects where we will see data quality tools will get better support for other data domains and the data quality dimensions that are essential here.

ML and AI data quality use cases will continue to be implemented and go beyond the current trial stage to be part of operational business processes though still at only a minority of organizations.

Happy New Year.

In the MDM sphere a key challenge with B2B2C is that you probably must encompass more surrounding applications and ensure a 360-degree view of party, location and product entities as they have varying roles with varying purposes at varying times tracked by these applications. You will also need to cover a broader range of data types that goes beyond what is traditionally seen as master data.

In the MDM sphere a key challenge with B2B2C is that you probably must encompass more surrounding applications and ensure a 360-degree view of party, location and product entities as they have varying roles with varying purposes at varying times tracked by these applications. You will also need to cover a broader range of data types that goes beyond what is traditionally seen as master data.