During my engagements in selecting and working with the major data management tools on the market, I have from time to time experienced that they often lack support for specialized data management needs in minor markets.

Two such areas I have been involved with as a Denmark based consultant are:

- Address verification

- Data masking

Address verification:

The authorities in Denmark offers a free of charge access to very up to data and granular accurate address data that besides the envelope form of an address also comes with a data management friendly key (usually referred to as KVHX) on the unit level for each residential and business address within the country. Besides the existence of the address you also have access to what activity that takes place on the address as for example if it is a single-family house, a nursing home, a campus and other useful information for verification, matching and other data management activities.

If you want to verify addresses with the major international data managements tools I have come around, much of these goodies are gone, as for example:

- Address reference data are refreshed only once per quarter

- The key and the access to more information is not available

- A price tag for data has been introduced

Data Masking:

In Denmark (and other Scandinavian countries) we have a national identification number (known as personnummer) used much more intensively than the national IDs known from most other countries as told in the post Citizen ID within seconds.

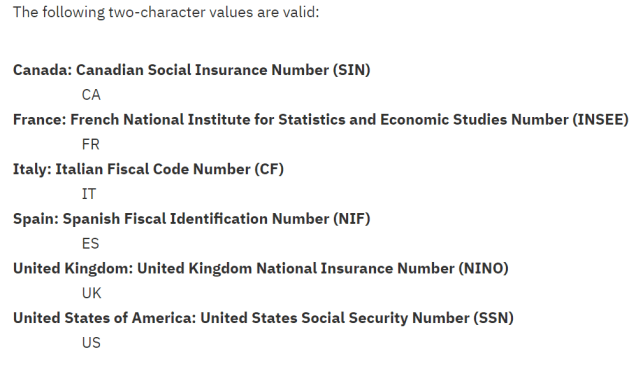

The data masking capabilities in major data management solutions comes with pre-build functions for national IDs – but only covering major markets as the United States Social Security Number, the United Kingdom NINO and the kind of national id in use in a few other large western countries.

So, GDPR compliance is just a little bit harder here even when using a major tool.

Master Data Management (MDM) went into the 2nd decade some years ago as reported in the post

Master Data Management (MDM) went into the 2nd decade some years ago as reported in the post  I resonate very well with the AllSight Advantage that is: “The hardest part about understanding the customer is representing them within archaic systems designed to manage ‘customer records’. AllSight manages all customer data in its original format. It creates a realistic and accurate likeness of who your customer actually is. Really knowing your customer is the first step to being intelligent about your customers.”

I resonate very well with the AllSight Advantage that is: “The hardest part about understanding the customer is representing them within archaic systems designed to manage ‘customer records’. AllSight manages all customer data in its original format. It creates a realistic and accurate likeness of who your customer actually is. Really knowing your customer is the first step to being intelligent about your customers.”

For the second time this year there is a Gartner Magic Quadrant for Master Data Management Solutions out. The two leaders, Orchestra Networks and Informatica, have released their free copies

For the second time this year there is a Gartner Magic Quadrant for Master Data Management Solutions out. The two leaders, Orchestra Networks and Informatica, have released their free copies  The Gartner Magic Quadrant for Data Quality Tools 2017 is out. One place to get it for free is

The Gartner Magic Quadrant for Data Quality Tools 2017 is out. One place to get it for free is