In the recent Gartner Magic Quadrant for Master Data Management Solutions there is a bold statement:

“By 2023, organizations with shared ontology, semantics, governance and stewardship processes to enable interenterprise data sharing will outperform those that don’t.“

The interenterprise data sharing theme was covered a couple of years ago here on the blog in the post What is Interenterprise Data Sharing?

Interenterprise data sharing must be leveraged through interenterprise MDM, where master data are shared between many companies as for example in supply chains. The evolution of interenterprise MDM and the current state of the discipline was touched in the post MDM Terms In and Out of The Gartner 2020 Hype Cycle.

In the 00’s the evolution of Master Data Management (MDM) started with single domain / departmental solutions dominated by Customer Data Integration (CDI) and Product Information Management (PIM) implementations. These solutions were in best cases underpinned by third party data sources as business directories as for example the Dun & Bradstreet (D&B) world base and second party product information sources as for example the GS1 Global Data Syndication Network (GDSN).

In the previous decade multidomain MDM with enterprise-wide coverage became the norm. Here the solution typically encompasses customer-, vendor/supplier-, product- and asset master data. Increasingly GDSN is supplemented by other forms of Product Data Syndication (PDS). Third party and second party sources are delivered in the form of Data as a Service that comes with each MDM solution.

In this decade we will see the rise of interenterprise MDM where the solutions to some extend become business ecosystem wide, meaning that you will increasingly share master data and possibly the MDM solutions with your business partners – or else you will fade in the wake of the overwhelming data load you will have to handle yourself.

So, watch out for not applying interenterprise MDM.

PS: That goes for MDM end user organizations and MDM platform vendors as well.

In the MDM sphere a key challenge with B2B2C is that you probably must encompass more surrounding applications and ensure a 360-degree view of party, location and product entities as they have varying roles with varying purposes at varying times tracked by these applications. You will also need to cover a broader range of data types that goes beyond what is traditionally seen as master data.

In the MDM sphere a key challenge with B2B2C is that you probably must encompass more surrounding applications and ensure a 360-degree view of party, location and product entities as they have varying roles with varying purposes at varying times tracked by these applications. You will also need to cover a broader range of data types that goes beyond what is traditionally seen as master data.

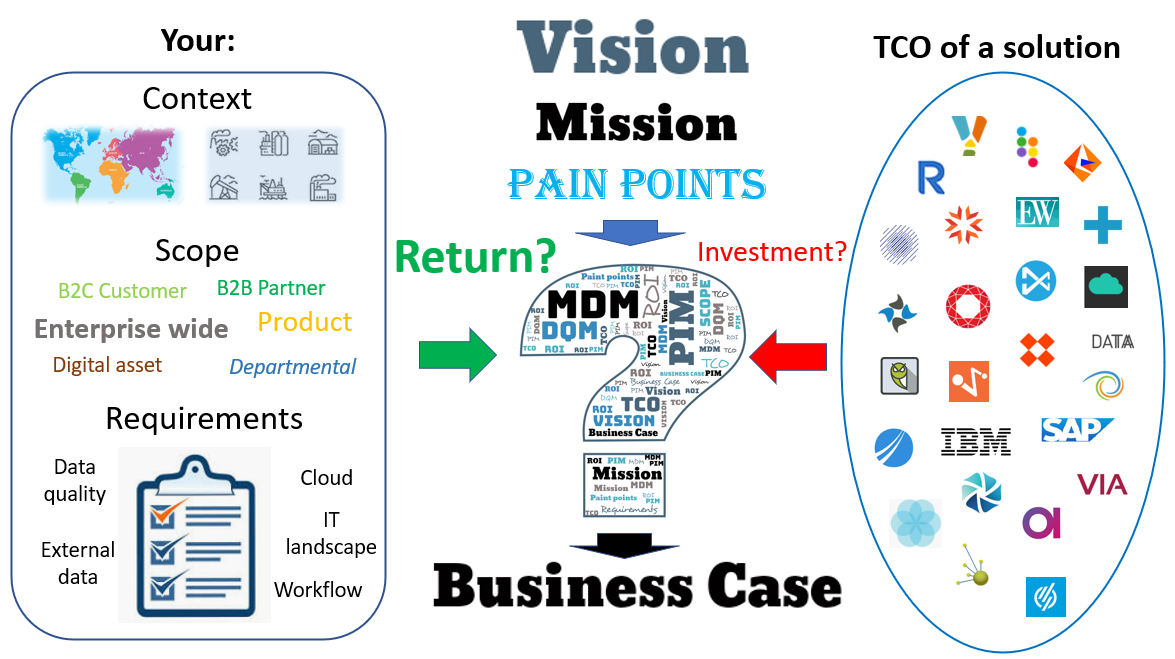

The selection model is based on the context, scope and requirements for your solution.

The selection model is based on the context, scope and requirements for your solution. The solution capabilities considered in the selection process are those of who are:

The solution capabilities considered in the selection process are those of who are: These two sets of information are compared in a continuously supervised learning algorithm – also known in marketing as machine learning and artificial intelligence (AI).

These two sets of information are compared in a continuously supervised learning algorithm – also known in marketing as machine learning and artificial intelligence (AI). The outcome is:

The outcome is: PS: The next feature on the site is planned to be The Case Study List. Stay tuned.

PS: The next feature on the site is planned to be The Case Study List. Stay tuned.